Which option is there for the establishment of a DIRECT FOREIGN CAPITAL COMPANY?

Foreign investors who want to invest in Vietnam in the form of a company establishment have many options. Direct and Indirect. Each option has its own advantages and disadvantages, and the procedure for the documentation that needs to be prepared is also different.

To save costs when establishing a company. ABA VISA & LAW SERVICES There are always the best options for investors. In this article, ABA Law advises on company establishment procedures (Indirect option) to save costs for investors.

Advantages of establishing indirect foreign capital companies

Cost savings Simple application profile No proof of capital required when established No Investment Certificate required.

Disadvantages of establishing foreign-owned companies indirectly

Original Vietnamese name must be found. Possibility of inheritance risk. Not suitable for conditional investment sectors.

REQUEST DOCUMENTATION

(applicable to areas under WTO commitments) Note: Documents investors need to prepare are applicable to all types of businesses. Note: Documents in foreign languages must be consular legalized and notarized translated into Vietnamese.

Results of the table

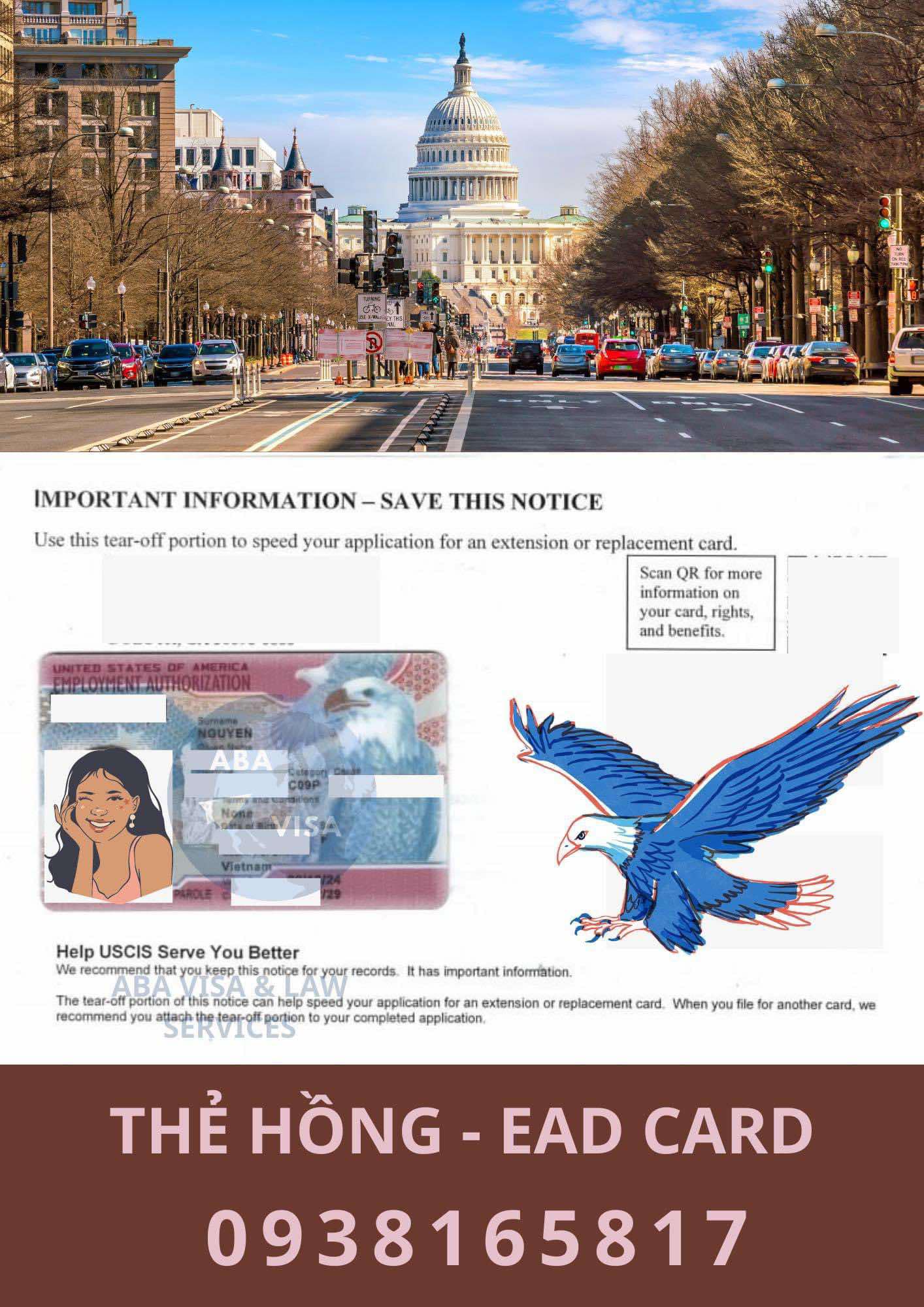

All legal documents as required by the customer SERVICE CHARGE IS INCLUDED

1. Full state fees.

2. 10% VAT (including VAT invoice).

3. Translation and notarization of relevant documents.

4. Delivery of documents to the place as required.

For individuals

Notarized copy of Vietnamese ID card / Identity card / Passport Notarized copy of Investor's Passport.

For organization

Copy of Business License/Certificate of Business Registration Copy of passport/Passport of the representative of contributed capital.

For a free consultation please contact ABA VISA by Hotline: 0938165817